Are you looking for a reliable trading platform with competitive fees and advanced tools? In this review, we break down everything you need to know about Eightcap. We show you everything from how it works to fees, features and how to open an account in only 5 minutes.

- Tight spreads from 0.0 pips

- Minimum deposit of only 100 USD

- Easy and quick to open an account

- Commission-free trading on tech stocks

- Limited crypto leverage

- Only CFD trading available

- Narrow selection of instruments to trade

- Commission of 3.50 USD per trade on Raw account

Overview

CHAPTER 1

Eightcap 3 account types and fees

CHAPTER 2

Open an account in 5 minutes

CHAPTER 3

What is Eightcap?

CHAPTER 4

Instruments and asset classes

CHAPTER 5

Platforms and tools

FAQ

Frequently Asked Questions

PLATFORM

View Screenshots

CONCLUSION

Pros and Cons

CHAPTER 1

Eightcap 3 account types and fees

Eightcap offers three different account types. Each comes with its own fees, features and limits. Below you’ll find a quick overview of what makes each Eightcap account unique, followed by a short explanation of each one of them.

Account comparison:

| Feature | 1. Standard Account | 2. Raw Account | 3. TradingView Account |

|---|---|---|---|

| Spreads | From 1.00 pip | From 0.00 pip | From 1.00 pip |

| Commission | None* | 3.5 USD / 2.75EUR per standard lot traded | None* |

| Minimum deposit | 100 USD | 100 USD | 100 USD |

| Min / Max trade size | 0.01 / 100 lots | 0.01 / 100 lots | 0.01 / 100 lots |

| Instruments available | 800+ | 800+ | 800+ |

| Margin call level | 80 % | 80 % | 80 % |

| Base currencies | AUD, USD, EUR, GBP, NZD, CAD and SGD | AUD, USD, EUR, GBP, NZD, CAD and SGD | AUD, USD, EUR, GBP, NZD, CAD and SGD |

| Scalping | Allowed | Allowed | Allowed |

(Updated 2025)

*Shares include commission.

Choosing between Eightcap’s three accounts really comes down to how you like to trade, how often you click the button and how much cost clarity you need. Here below you can read shortly about each account in detail and what kind of trader that should be in each one of them.

1.1

Standard account

If you’re new to CFD trading or simply don’t want to keep track of extra charges, the “Standard Account” keeps pricing simple. Here the broker bakes its charge into the spread and there is no commission on most products. Because you pay nothing extra, you never have to make an extra calculation for example break‑even levels.

The entry bar is low with a minimum deposit starting at 100 USD. This is affordable for most beginners. Further on, margin‑call and stop‑out levels are set at 80 % and 50 % respectively, giving beginners a little breathing room before positions are forcibly closed.

1.2

Raw account

If every fraction of a pip matters, you should consider using a “Raw account”. It’s not recommended for beginners. Instead, it is mostly suited for active scalpers or algo traders who make several trades each day.

Spreads on the “Raw account” can go as low as 0.0 pips when trading the major currency pairs. However, Eightcap adds a flat commission of 3.50 USD per standard lot. The account shares the same 100 USD minimum deposit as the “Standard Account”.

1.3

TradingView account

The “TradingView Account” is mostly suited for you who already have a TradingView account and have your workflow already living inside TradingView’s charts. Execution happens directly on TradingView, where you can draw, analyze and chat with the TradingView-community.

This set‑up is perfect for visual, discretionary traders who annotate charts extensively. Through this account type you can also use already made scripts from other traders, directly available on TradingViews platform.

1.4

Try a demo account to get started

If you’re totally new to trading and would like to try out Eightcaps platforms, without risking your own capital, we recommend you open a Demo Account. Eightcap pre-loads it with 100 000 USD in virtual funds, which is enough to try out the platform.

Everything you can do with the demo account…

- Trade all 800‑plus CFD:s.

- Practice risk management under actual margin rules.

- Back‑test and forward‑test robots or scripts in a live data stream.

- Explore the platforms’ plug-ins from MT4, MT5, WebTrader and TradingView.

Whether you are brand new to trading or simply want to verify Eightcap’s spreads, the demo account lets you use all the attributes on the platform, without risking your own money. Whenever you feel comfortable you can quickly switch to a “Standard Account” and start trading with real money.

(Source: Eightcap)

CHAPTER 2

Open an account in 5 minutes

In this chapter we show you how to open an account at Eightcap in only 5 minutes. We also show you how to make a trade with one of the external trading platforms that can be connected to your Eightcap-account.

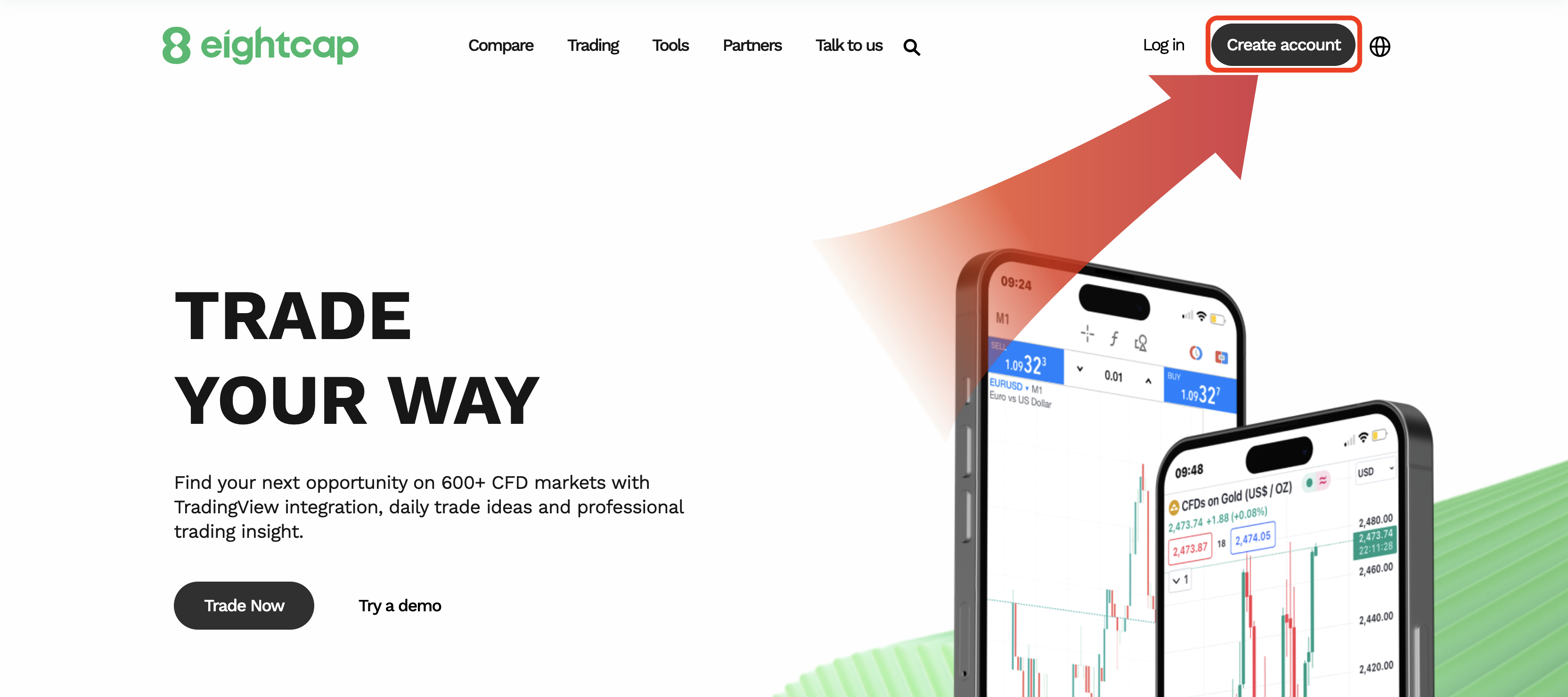

1. Go to Eightcaps’ website

The first step is to go to Eigthcaps’ website. To get started, follow this link and click “Create account”.

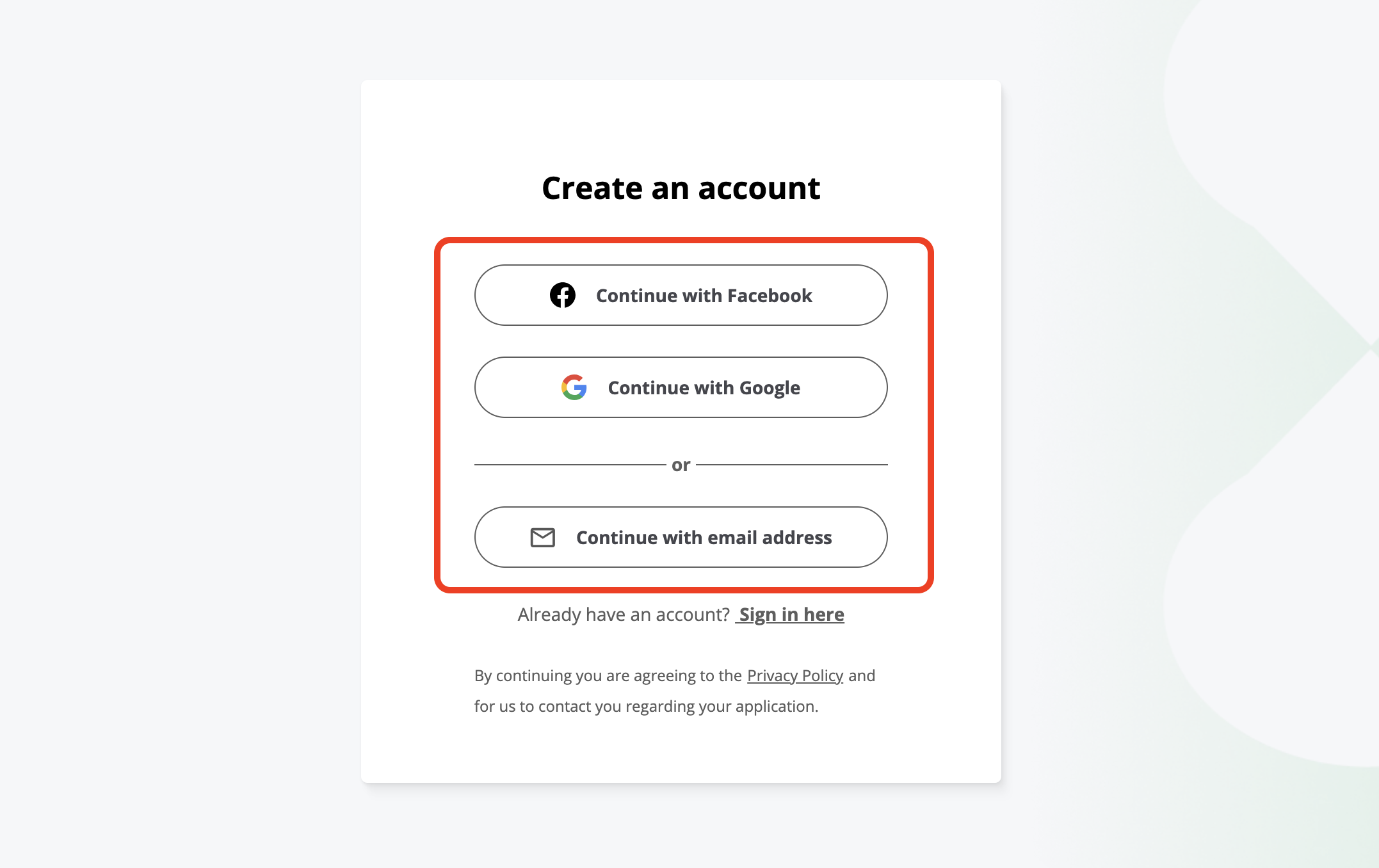

2. Register your account

In this step you need to register an account. Register by either choosing Facebook, Google or email address. If you choose your email address, you will be sent a confirmation code.

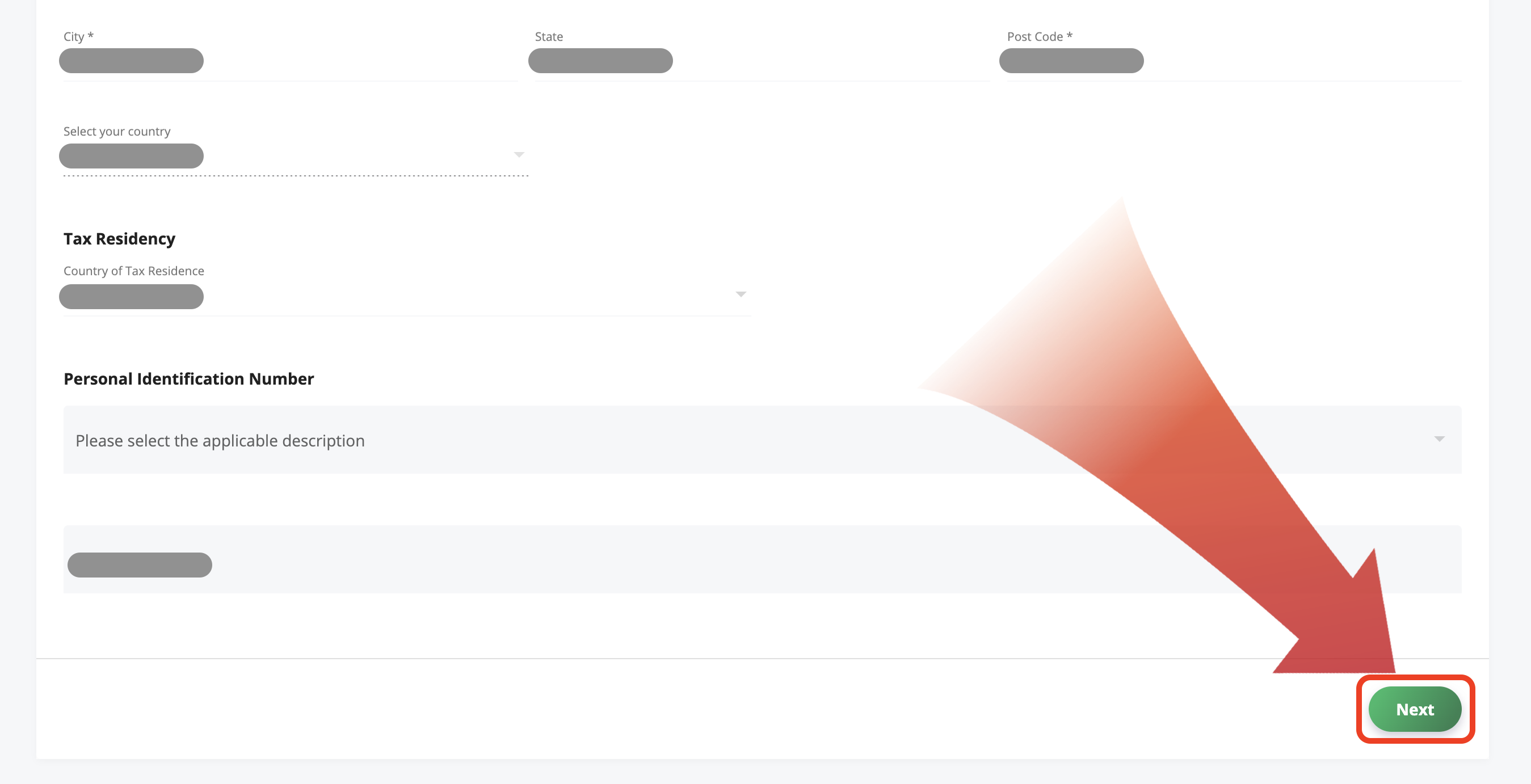

Eightcap will ask you for your personal information such as residence country, address, identification number. After filling all the necessary information click “Next”.

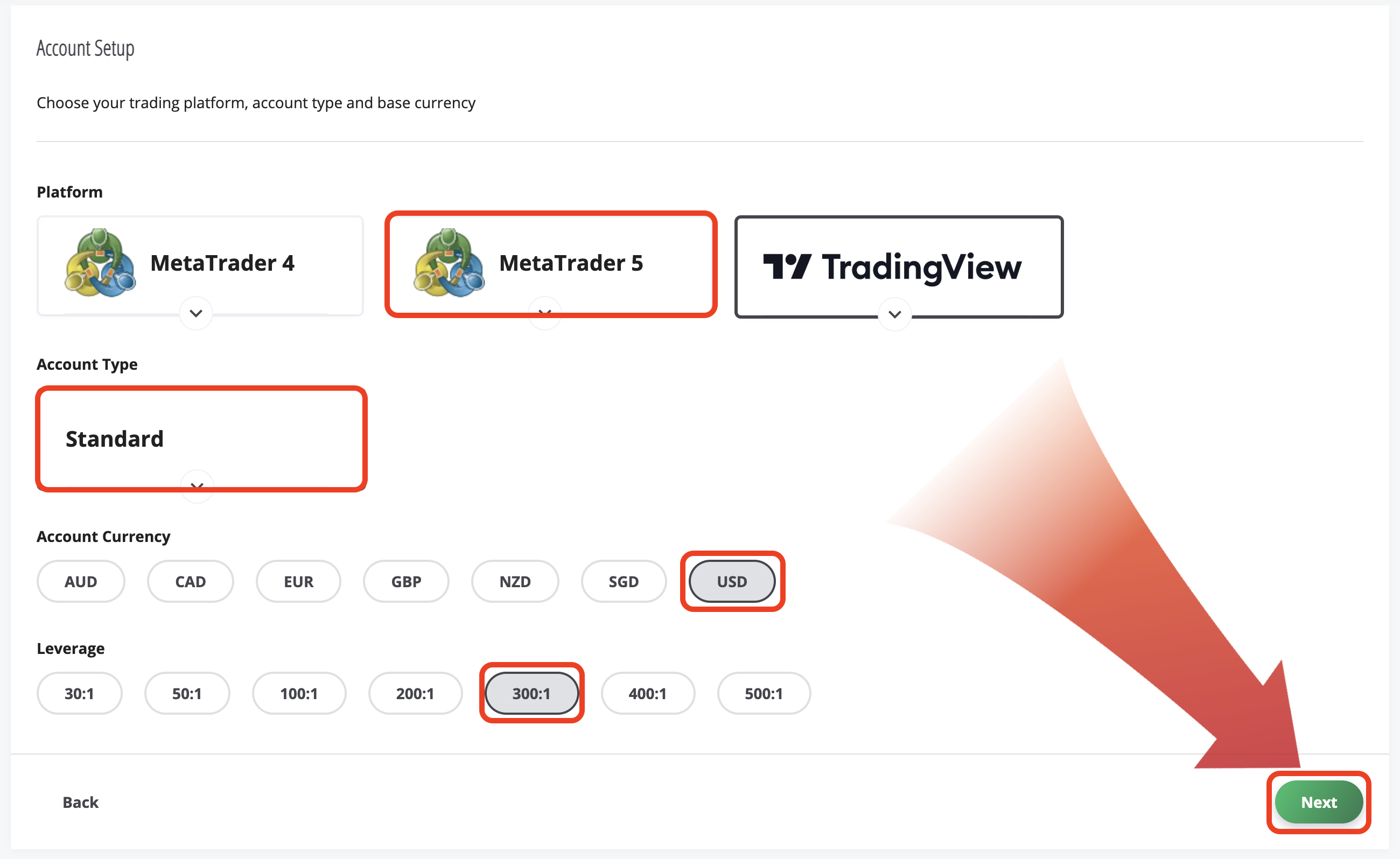

3. Set up an account

In the following step you need to set up your account. Choose an external trading platform (if you are using one). Then choose account type, account currency and lastly Leverage ratio.

In this example we choose “MetaTrader 5” as our external platform, “Standard” as our account type, “USD” as our currency and “300:1” as our leverage ratio. Whenever ready, click “Next” to proceed.

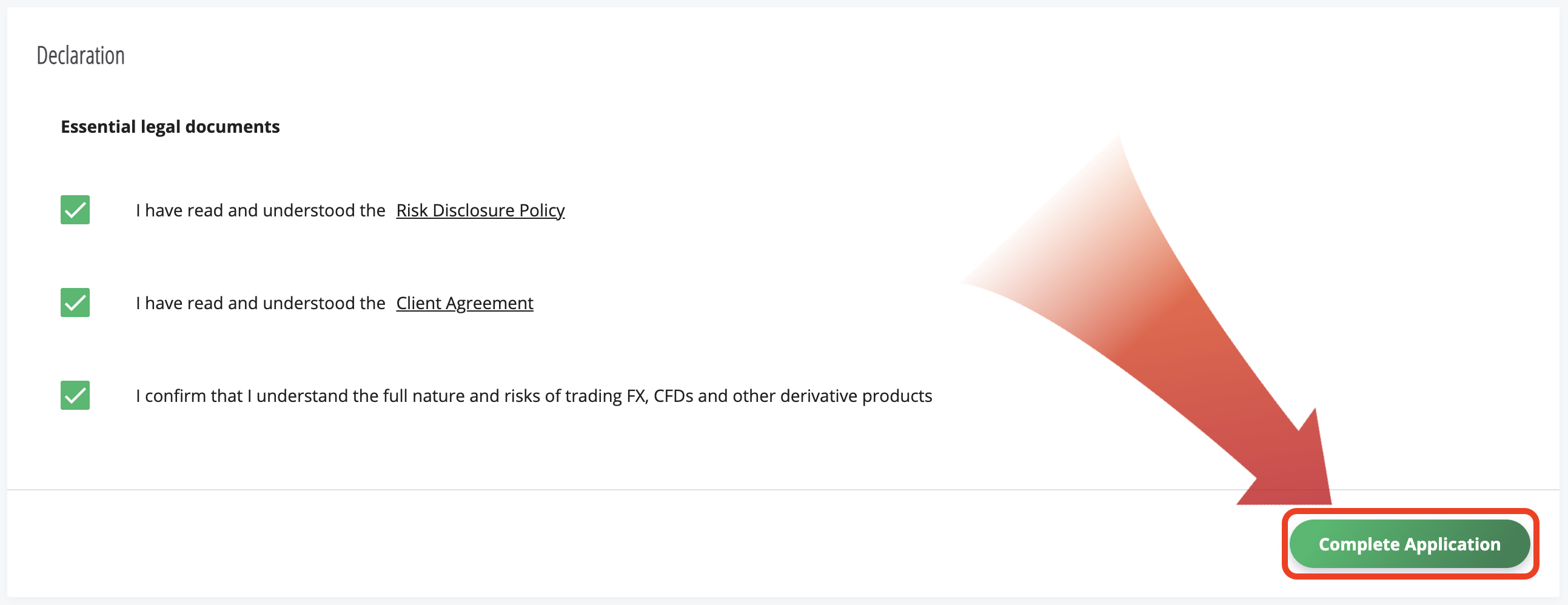

In this step you need to accept all the terms. Make sure that you have responded correctly through the registration process. Click “Complete Application” to finish the registration.

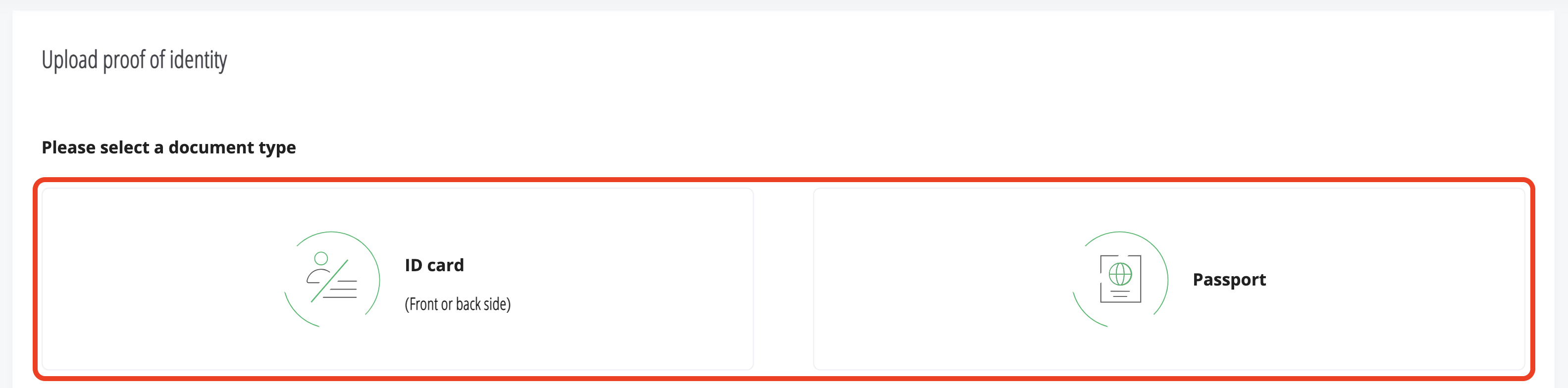

In this step Eightcap will ask you for either “Proof of identity” or “Proof of Address” in order to verify your identity. Choose whatever option that suits you and upload the legal documents that they ask for. Click “Next” to proceed to the following step.

4. Account funding

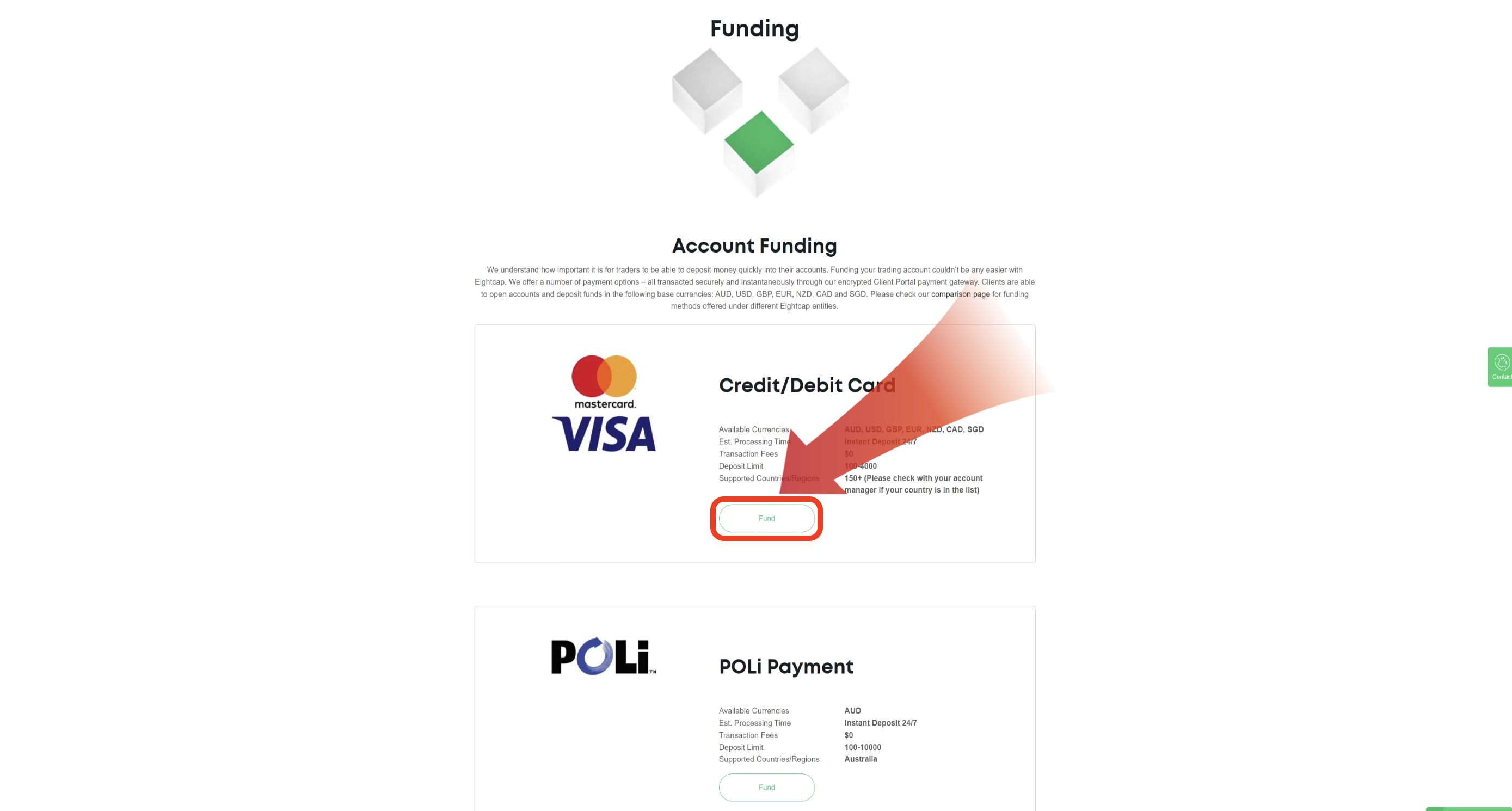

Eightcap accepts different deposit methods to your account. They offer 0 % fees, support more than 150 countries and offer an instant deposit starting at a minimum of 100 USD. In this example we choose “Credit/Debit Card” by clicking “Fund”.

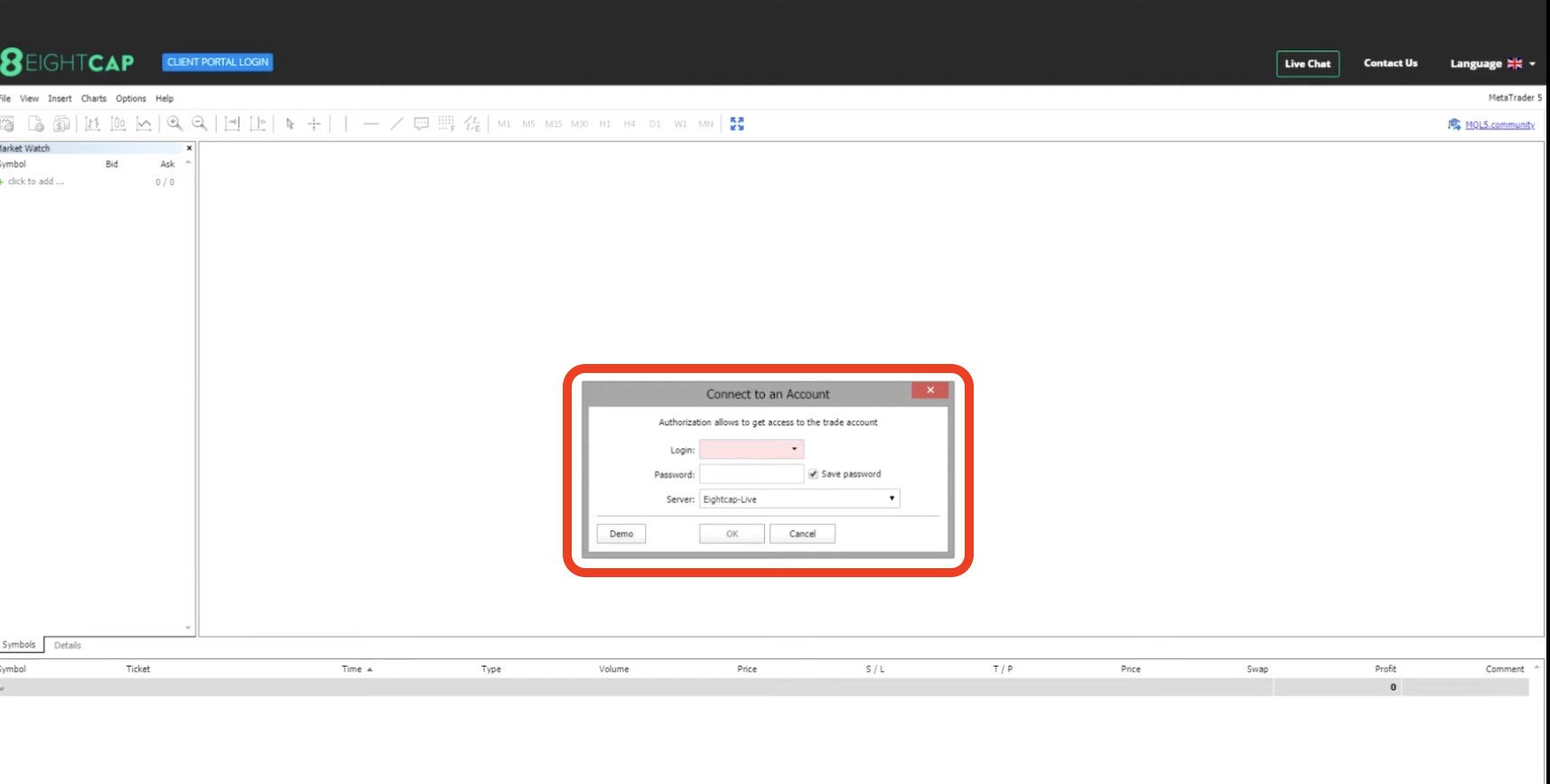

5. Connect account to trading platform

You can now connect Eightcap to an external trading platform. In this example we have chosen to connect the account to MetaTrader 5. Fill in your password, server and click “OK” when ready. You should now have full access to the platform.

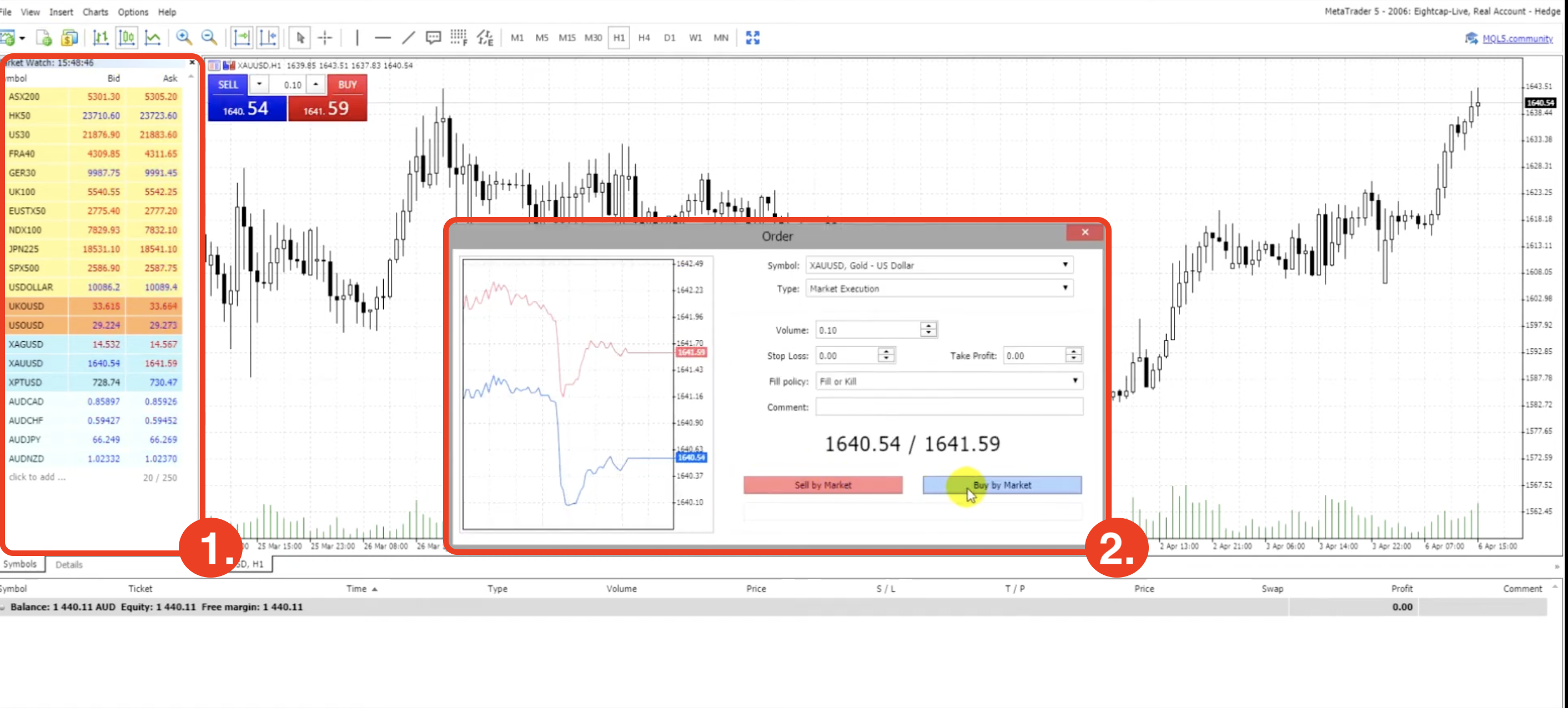

6. Place a trade

On the left side is the market watch window. From there you can select any available asset to trade by clicking on the instrument and selecting “New Order”.

Choose type of trade, volume, stop loss, take profit, etc. Whenever ready press either “Sell by Market” or “Buy by Market”, depending on if you want to take a short or long position.

That’s it, well done!

CHAPTER 3

What is Eightcap?

Eightcap is a global Forex and CFD broker founded in 2009. Their platform offers access to over 800 financial instruments including forex, commodities, shares, indexes and cryptocurrencies. As such, traders have vast access to different kinds of financial markets.

The trading platform is known for its user-friendly interface, competitive spreads, fast execution, and integration with MetaTrader 4 and 5. This makes the platform suitable for both beginner and advanced traders.

How does Eightcap work?

Eightcap operates as a CFD (Contract for Difference) broker. This means traders don’t buy the actual asset. Instead, they only speculate in their price movements, without owning the underlying assets.

On their platform you can trade both long and short, with the accessibility to leverage your position if you wish so. Trades can be made using either MetaTrader 4 / 5 or TradingView via Eightcap.

Users can fund accounts, place trades, use tools like FlashTrader and access educational materials – all from a single dashboard. This makes Eightcap a complete trading platform for both beginners and more advanced traders.

(Source: Eightcap)

CHAPTER 4

Instruments and asset classes

Eightcap offers you to trade with CFD contracts in five different instrument categories. These include (1) “Forex”, (2) “Commodities”, (3) “Stocks”, (4) “indexes” and (5) “Cryptocurrencies”. Below is written about them in detail.

4.1

Forex

Eightcap’s FX desk covers +40 pairs, including everything from pairs like EUR /USD and GBP/JPY to emerging‑market crosses. The Forex market is the largest financial market in the world, making it highly liquid and volatile.

The highest available leverage ratio for currencies at Eightcap is up to 1:500. The cost of trading them is very low, especially on major pairs with a common spread shifting between 0 – 0.2 pips.

4.2

Commodities

Whether you want a classic gold hedge or prefer to speculate on crude oil, Eightcap’s commodity matrix gives you spot contracts on several popular commodities. The most traded commodities include gold, silver, Brent oil and WTI.

The leverage ratio differs between commodities. The maximum leverage that you can use is 1:500. The spread for trading commodities differs between 0.1 and 3 pips.

4.3

Stocks

One of the most popular assets classes to trade on Eightcap are stocks. The platform lists +500 equities. The most beneficial attribute when trading stocks on Eightcap is the 0 % commission for big tech names such as Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL), Meta Platforms (META) and Netflix (NFLX).

Eightcap lets you apply up to 1:500 leverage on your trades. For example, if you wish to use a leverage ratio of 1:20, it means that if Apple goes up with 2 % your total profit will be 40 % (2 x 20). Important to know is that corporate actions, such as dividends and splits, are adjusted automatically so your charts stay clean.

4.4

Indexes

If you prefer trading whole economies rather than individual companies, Eightcap offers the availability of trading famous indexes such as US30, AUS200, UK100 and GER40. Trading indexes offer exposure to entire markets ideal for portfolio diversification or macro bets.

The maximum leverage ratio when trading indexes is 1:500 for retail traders. The spread varies between 0 and 16 pips, depending on which market you want to trade.

4.5

Cryptocurrencies

Currently, you can trade over 100 cryptocurrencies at Eightcap. Popular crypto currencies to trade include Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and ADA (Cardano). Compared to the other markets mentioned above, the crypto market trades 24/7.

Through CFD:s you can go long or short without the hassle of wallets or cold storage. This is a big advantage for traders who only want to focus on the price actions.

CHAPTER 5

Platforms and tools

Eightcaps platform comes with a lot of different features such as API:s, tools and educational guides. These can all be benefited by beginners and experienced traders who are seeking more advanced features for their trading strategies.

5.1

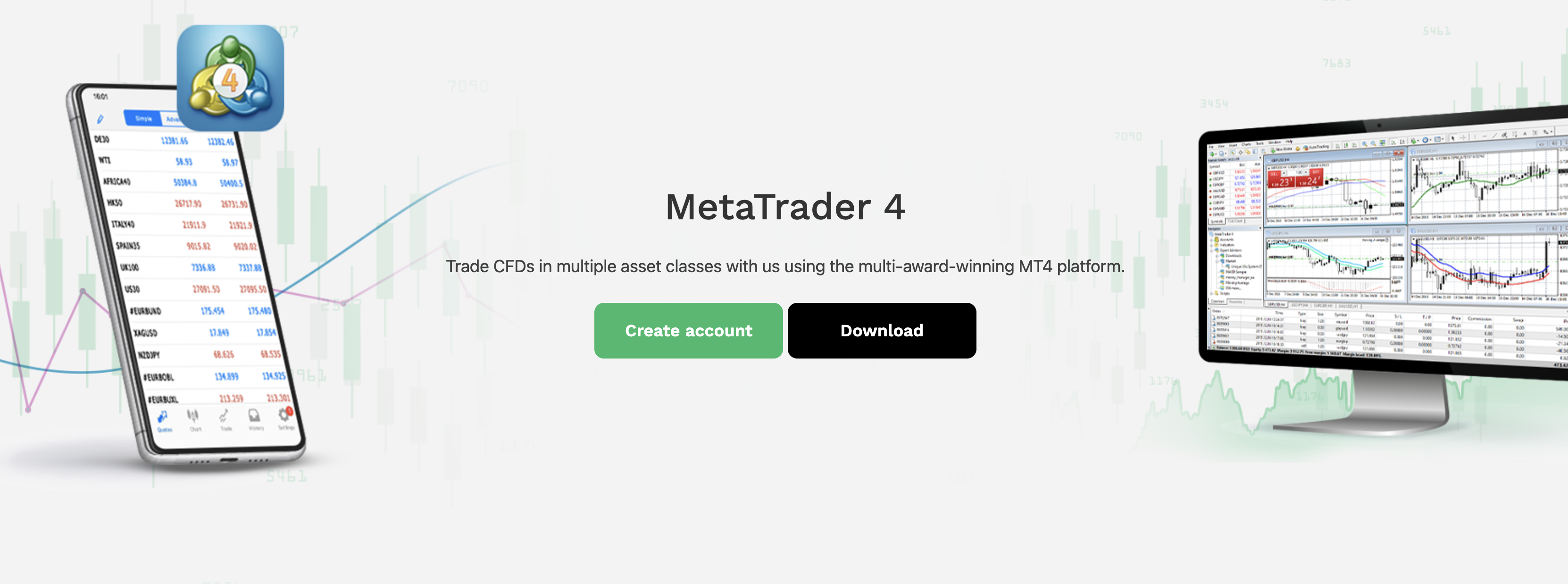

Trading platforms

One of the most unique attributes on Eightcaps platform is the connection into external trading programs, such as MetaTrader 4, MetaTrader 5 and TradingView. On each of these platforms you can simply copy other traders’ strategies, create your own script and execute orders.

- MetaTrader 4 – Eightcap hosts MT4 servers in Equinix data centers and lets you download the terminal for Windows, macOS, WebTrader and mobile in one click.

- MetaTrader 5 – Eightcap offers free MT5 downloads on desktop, web and mobile with direct login to its “Raw” or “Standard accounts”.

- TradingView – Eightcap’s direct API integration lets you log in to a live or demo account and place orders straight from TradingView charts.

MT4 and MT5 dominate the retail‑trading space and TradingView dominates web charting. Supporting all three means new clients don’t have to relearn a platform. Trading can take place on the platform that each trader prefers, without having to leave them.

(Source: Eightcap)

5.2

Trading tools

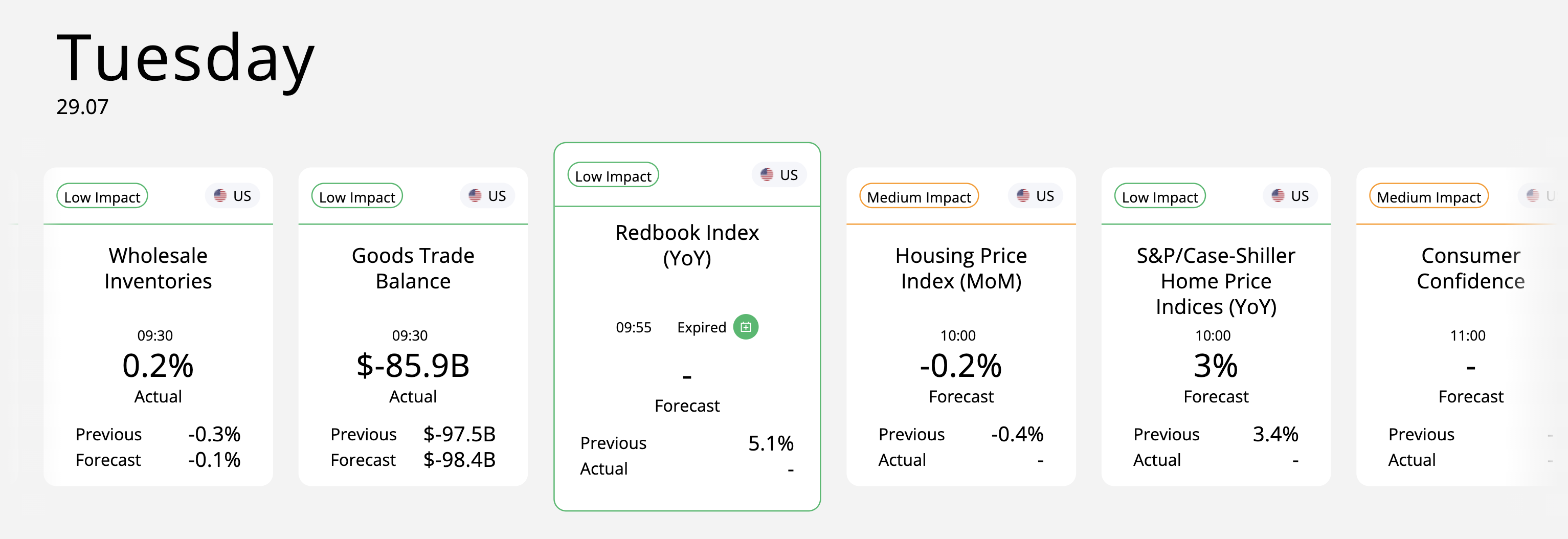

Some unique trading tools that Eightcap has to offer are “AI-powered economic calendar” and “FlashTrader”. These tools are built in partnership with external entities which gives Eightcaps platforms a competitive advantage.

AI-powered economic calendar

Eightcap | AI-powered economic calendar by Acuity:

Eightcap’s AI‑powered Economic Calendar is a smarter, data‑driven tool for tracking macroeconomic events. Unlike standard calendars, it uses AI (artificial intelligence) to analyze over 1 000 global economic events across more than 100 countries.

This helps traders see not just what is coming, but how it might impact the market. The tool suggests assets likely to move, helping you decide what to watch for, just like a trading assistant.

By filtering key events and understanding their expected impact, you can avoid unexpected surprises. This is a key-tool for every trader who wants to avoid sudden news that can affect their technical analysis negatively. The AI-tool can be integrated to external trading programs such as MT4 or MT5.

(Source: Eightcap)

Before using the AI-tool you should have a basic understanding on how different economic events affect the market. Thus, you will have a better understanding of why the AI-tool is telling you different outcomes.

FlashTrader

Flash Trader – Turn the perfect trading plan into reality:

FlashTrader is an expert advisor (EA) plug‑in exclusively for MetaTrader 5 on Eightcap. It helps you place trades quickly and safely by doing the hard work for you, like calculating how much to risk, setting stop-losses and picking profit levels.

This lets you trade precisely without having to focus on the calculator, instead your trading strategy. This feature was made by Eightcap and BKForex to help traders save time and avoid mistakes. With just one click, FlashTrader will open your trade and automatically set:

- The right trade size (so you don’t risk too much).

- A stop-loss (to limit losses).

- Profit targets (so you can close the trade when it hits your goal).

FlashTrader is great for beginners who want help with trade size and risk settings. It is also a great tool for more professional day traders and scalpers who trade often and need speed, consistency and want to save time.

To use FlashTrader, you only need to activate an Eightcap MT5 account. The EA can then be downloaded directly from your client portal for lifetime access.

(Source: Eightcap)

Frequently Asked Questions

Is your question not answered here? Let us know!

Screenshots of

Pros and Cons with

- Tight spreads from 0.0 pips

- Minimum deposit of only 100 USD

- Easy and quick to open an account

- Commission-free trading on tech stocks

- Limited crypto leverage

- Only CFD trading available

- Narrow selection of instruments to trade

- Commission of 3.50 USD per trade on Raw account

FORUM

Join The Discussion!